| |

||||||||||||||||||||||

|

|

||||||

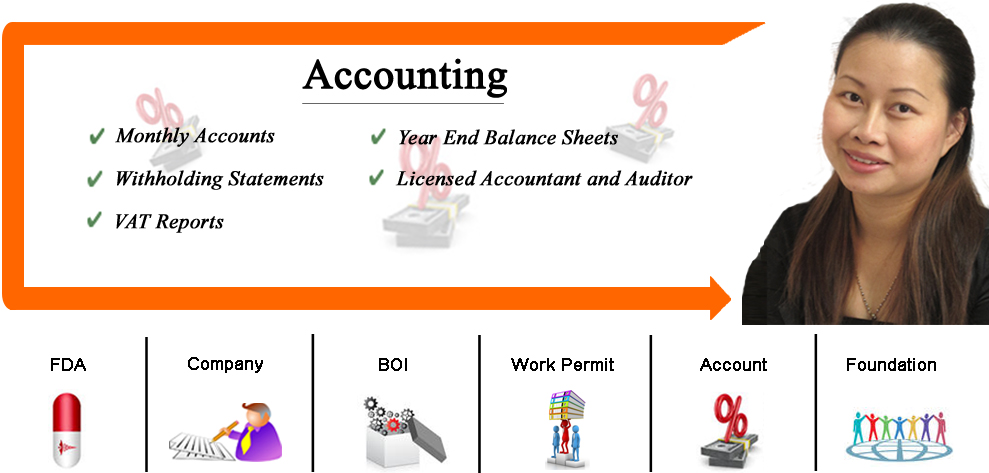

Q: Why does a company with a site named Thailand Lawyer offer accounting services? In Thailand it is customary for law offices to provide accounting services. This is particularly true for law firms that deal with companies with foreign employees, since foreign companies have special accounting and regulatory requirements. Q: What is the advantage of hiring a law firm that specializes in Thai law as it applies to foreigners for accounting services? To support the foreign staff's visa and work permits, accounting documents must be supplied to the Immigration police and Labour Department. Therefore, it is only sensible that a single firm handles foreigners' legal matters, company legal matters, accounting, visa and work permits. We specialize in assisting foreign companies in Thailand and we have special expertise in translating and interpreting Thai laws and business practice for foreign company directors and foreign staff. Q: Does your staff use licensed accountants to provide accounting services? We have licensed accountants and auditors, as well as bookkeepers on our staff. We are able to provide accounting services and documents translated into English. Accounting Services

Payroll Services

FAQs You Can Use: |

Before taking any legal action, persons are advised to seek the advice of a lawyer qualified in the area of law concerned.)

Home | Real Estate Law | Land Purchase | Land

Lease | Condo Purchase | Usufruct | Company

Registration| US Fiance and Marriage Visa | US Visa

| Will and Estate planning | Probate | Amity Companies | Investigation | US K3 marriage visa | US K1 Fiance visa | US F1 and J1 visa | B1 and B2 visa

Prenuptial

Agreements | Divorce | Personal Injury | Criminal Defense | Service of Process | Thailand Lawyers | Bangkok Lawyer | Thailand Divorce Attorney Blog

Thailand

Law Partners:

Thailand Law Forum | US

Fiance Visa Lawyer Thailand | Thailand

Law Firm and Attorney

Copyright © 2001-2017 Chaninat & Leeds